Table of Contents

Money confuses me. So much!

I’ve always had a bit of a problem understanding economics. It just makes no sense to me. And now in my adulthood, I’m trying to play catchup to understand things, and maybe figure out where I fit into the mix… before my energy runs out, and I no longer have what it takes to get my piece of the pie.

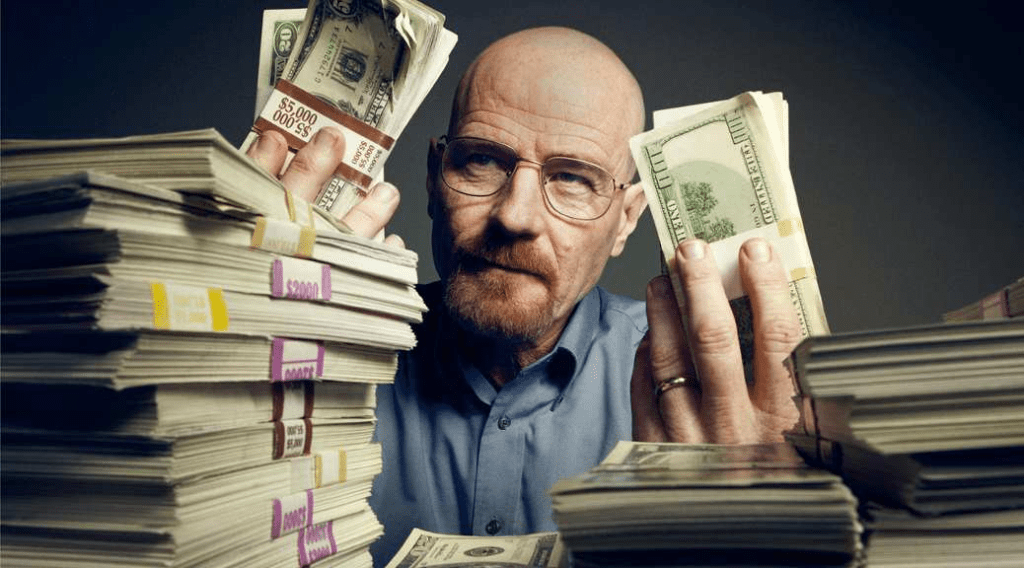

In trying to understand things, I started to read books that might get me past my little hump. I started with Rich Dad, Poor Dad, a fantastically interesting work by Robert Kawasaki. I loved it. It was intriguing and showed me perspectives that were quite new to me. But I didn’t put the book down motivated to run out and make a difference. Nor did I feel like I had the knowledge or skills necessary to carry out his plans.

So I kept going.

I read books and articles and talked to people and experimented and… I’m still so damn confused!

Wealth and Health

After everything I’ve consumed, including some things I’m in the middle of, I’ve concluded that wealth acquisition is similar to health. Everyone feels like they possess the sole secret to rising to the top. And every other idea is a mistake, that will not help you achieve your goals.

As I write this doing a mini-course that claims the secret to financial independence is putting as much money as possible into assorted retirement accounts, like IRAs. Simultaneously I’m reading a book that claims retirement accounts are the conventional wisdom for how to retire comfortably, but that wisdom is absolutely 100% incorrect.

So what does one do in these circumstances?

I, like just about everybody, am thoroughly interested in passing the finish line. I want to ride off into the sunset at age 60 with a beautiful home, not a single financial concern in the world, and enough money that not only will I leave this world very comfortably, but the next generation or two will never feel the sting of financial panic.

What’s the Road to Money?

But do I follow Robert Kawasaki’s advice and create a large business? By his definition a large business is one in which there is a system in place, and if you were to step away for any length of time, the system would keep going. It’s not reliant on you, or any one individual for that matter. A doctor’s office would be a small business. It could make a ton of cash, but when the doctor’s on vacation, no income comes in. When the doctor retires, the business closes. The big business, on the other hand, has an easily transferrable system in place.

Kawasaki considers real estate the best method for doing this. Think about it. If you own a building, you collect rent on every unit. Forever. You can do whatever you like within the business, and hire others to do anything that doesn’t interest you.

You own. Someone else manages or does maintenance. And into your 90s, you sip on margaritas on the beach while your building continues to yank in wealth.

The course I’m currently taking, from Money with Katie, takes what I would consider a more traditional approach. Get rid of debts, starting with items with the largest interest rates (as opposed to Dave Ramsey, who says to conquer the smallest debts first, for the psychological boost of tackling an entire debt). Earn more, spend less, put whatever’s left over in savings accounts, like Roth IRAs. Retire comfortably in your 40s.

More Money, More Money

Another method I’ve seen as the wisdom to get ahead is to purchase multiple existing businesses that are profitable and capable of scaling into much bigger and more lucrative businesses. This is talked about extensively in a newsletter I read called Contrarian Thinking.

The 4-Hour Work Week has a whole philosophy and system based around doing as little work as possible and living how you want to live now, not when you retire. Too many details to get into what he recommends, but a worthy read. It’s mostly about getting paid a lot by people for whatever, and outsourcing the actual work to others who charge significantly less than you are making.

There’s of course this other mysterious way of investing advocated by my current book, Missed Fortune 101. I’m nowhere near answers at this point, just padding for what will hopefully be a decent payoff at some point. Happy to report again when I finally have all the answers!

And there are endless other things I’ve read along the way that hold the elusive secret to building wealth. Some version of diversifying income streams. Mastering the art of passive income. Strategizing the best ways to invest in the stock market. And, of course, shifting ones attitude so that your soul starts pulling happiness, health, and wealth into your life.

Conclusion: I’m Still Confused About Money

So once again, like so many other things in my life, I’m left confused. I’ve spent the better part of my adult life trying to figure out health. Some say soy is healthy, others say it’s the devil. Some tell you to drink lots of water, others warn of the dangers of over-hydrating, others still say it’s all dependent on what kind of water you are drinking. Should I eat organic or am I tossing money in the toilet? Do supplements work or do they just result in expensive urine? Does running actually help someone lose weight, or does it just make you hungrier and put too much pressure on your knees and other joints?

It’s enough to make you crazy!

But I never thought I would delve into this topic and find myself just as confused. And here we are!

Should I start a business from scratch? Or purchase someone else’s business? Should I just live a frugal life and keep plopping my savings into retirement accounts? Or should I live for today and learn how to outsource everything I do? Should I research and purchase individual stocks? Should I have seventeen different income streams? Should I just do all of the above and hope one of the methods hits pay dirt?

One thing’s for sure: Whatever I’ve done up to this point certainly hasn’t gotten me there…