Table of Contents

I just finished reading Robert Kiyosaki’s classic book Rich Dad Poor Dad, and I can’t stop talking about it.

But how did I get here?

A few weeks ago I felt the pain of missing the fantastic feel of a good book in my hand. I don’t know what happened to me along the way. I used to be able to sit for hours and enjoy the beauty and profundity of fiction. I even had a dream at one point of being a literature professor.

And somewhere along the way, it just fell to the side. Books turned to movies, and when my patience lessened even further, movies turned to TV shows. And most of the reading I did was non-fiction, and very sadly, articles on a computer screen.

But I missed the feel of a book. I missed the incredible accomplishment of getting to the other side, stacking up acquired wisdom through page after page of becoming one with the author’s knowledge.

And then I started again.

Rich Dad Poor Dad

No, I’m not pouring through hundreds of pages of fiction while lying on my couch for hours. I may get there some day. But for now, I’m enjoying a little bit here and there of some quality writing. But not just any kind of writing. Writing designed to get me where I want to be in life.

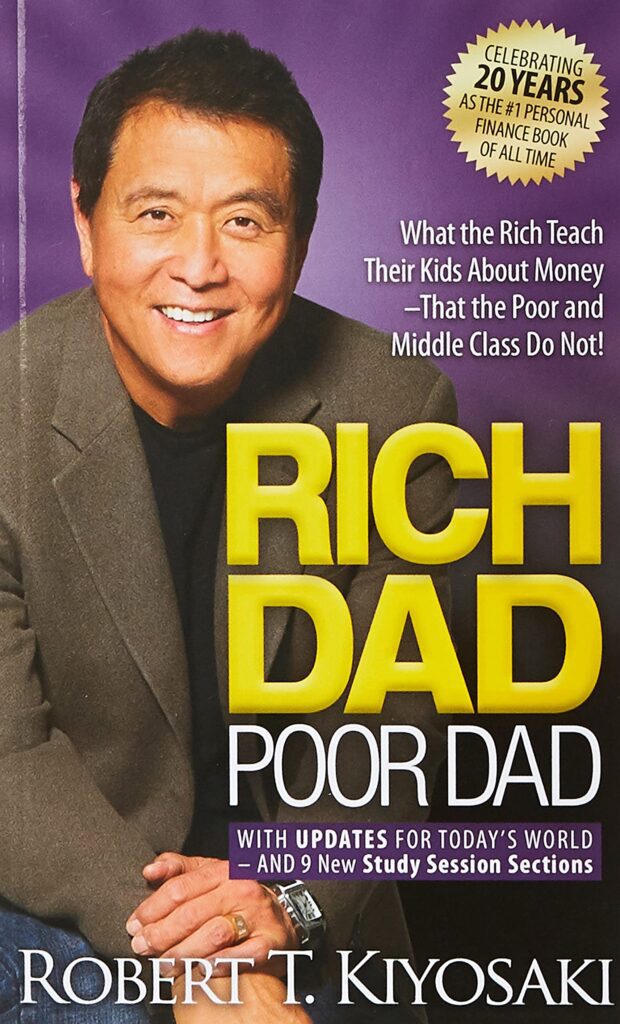

I just completed Robert Kiyosaki’s Rich Dad Poor Dad, after years of countless recommendations. And it was a perfect way to begin yet another step in my journey to get where I want to be in life.

Rich Dad Poor Dad is all about the lessons Kiyosaki learned as a child, comparing his upbringing from his father, a well-educated man who just couldn’t seem to ever have an overflowing bank account, with that of his friend’s wealthy father, who seemed to have money all figured out.

Here are some of the gems of wisdom I picked up along the way:

Rich Dad Poor Dad: Understanding Assets All Wrong

“Rich people acquire assets. The poor and the middle class acquire liabilities that they think are assets.”

This simple concept probably had a greater paradigm shift for me than any other portion of the book, since it so greatly fights against traditional wisdom and definitions.

For the longest time, I understood that an asset was anything in your possession that either had potential value (education) or increased in value (a home). A liability was something that decreased in value over time, which is most possessions.

Kiyosaki, on the other hand, disagrees. He says an asset is only something that earns you money. So unless you’re home exists to earn money, it’s a liability. You paid money for it. You’re constantly putting more money into upkeep and repairs. So unless you’re planning on selling it, or using it as a yoga studio or a basement rental, it’s a liability.

An asset would be something you own that puts money in your pocket, like an office building. Different offices are paying you rent, and money is coming to you monthly.

And you are considered “rich” when the money earned from your assets is enough that if you stopped working tomorrow, you would still be covered for all your needs and expenses.

And that’s the goal. Understanding the goal and the definitions is possibly the most important key to achieving financial independence.

Rich Dad Poor Dad: Money the Wrong Way

“Most people, given money, only get into more debt.”

This concept fascinated me. It’s not complex. It’s actually fully intuitive.

If you lack financial training and knowledge, you don’t know what to do when you possess money. Most think, “If I have ten dollars, I’ll spend ten dollars.” So when they have one hundred dollars, they spend that as well. It’s just money in, money out. There’s no adjustment that would make more money actually in the end equal even more money. It’s just a new version of financial difficulty, with more capital to screw up with.

The rich are smart with their money. The more they have, the more is invested in laying the foundation to make even more. And the cycle never ends.

And that’s the pattern that needs to be broken not only to become rich, but to become even richer. And to stay that way indefinitely!

Rich Dad Poor Dad: Taxing the Rich

“Every time people try to punish the rich, the rich don’t simply comply. They react. They have the money, power, and intent to change things. They don’t just sit there and voluntarily pay more taxes.”

It’s easy to hate the rich for playing the game better than the rest of us do. But let’s be honest: If we ever find ourselves with a hundred million in the bank, we’re probably going to do the same thing as well.

Robert Kiyosaki would not be a fan of people wearing dresses that say “Tax the rich”. In fact, I think he’d laugh at the notion and say something like, “Go ahead and try.” He presents the history of attempts to play Robin Hood, grabbing as much money as possible from wealthy people so the poor out there could have better lives. Unfortunately, more often than not this results in making the lives of the middle class more difficult. And the rich just continue on sipping Pina Coladas on their private beaches, while their brilliant and well-paid accountants find ways for them to keep their hard-earned loot.

Does wishing to tax the rich come from a place of demanding equity… or from a place of jealousy? Hard to tell really… but I can certainly say where I’d like to be in ten years. And whereas I’d be happy if I voluntarily gave a large chunk of cash to many amazing charities, I really could do without forking it all over to the government.

Rich Dad Poor Dad: It Ain’t Gambling

“It is not gambling if you know what you’re doing. It is gambling if you’re just throwing money into a deal and praying.”

Is investing just a high-stakes version of spending a wild night gambling in Vegas?

Yes… and no, not at all.

When you drop a coin into a slot machine or spin a Roulette wheel, you’re leaving the fate of your money to chance. But if you buy a stock or invest in a rental estate, whereas there is and will always be some elements of luck and chance, you change the game entirely when you throw in factors like education, research, and seeking quality advice.

No, you can never know when your thousand dollars will become two million in a month, but you stack the cards forever in your favor by doing the due diligence to make sure you’re not just tossing money into the wind.

RobertKiyosaki advocates for an extremely strong financial education. If you want to become rich and stay that way, you need to build the financial wisdom and knowledge that will support your goals. Any less, and you will be woefully underprepared for the task at hand.

You stack the cards forever in your favor by doing the due diligence to make sure you're not just tossing money into the wind. Share on X